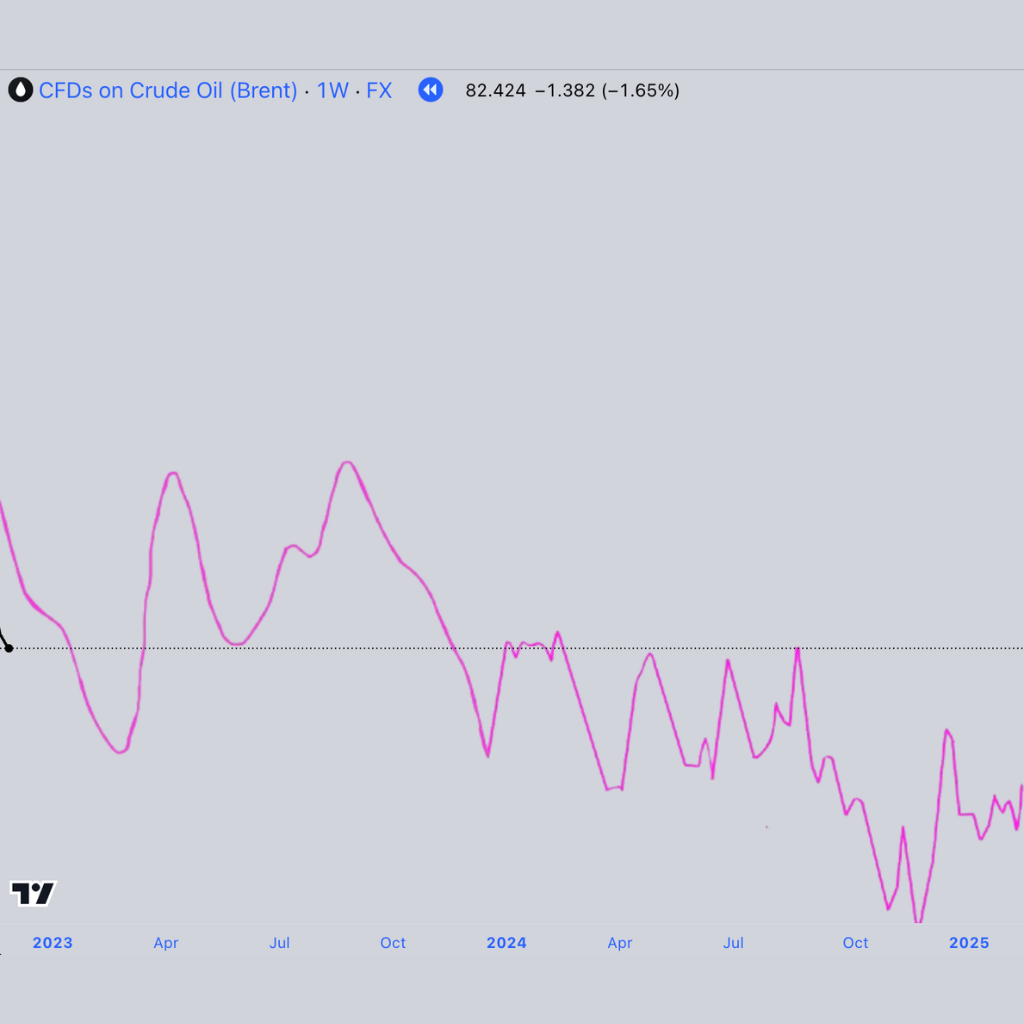

Phase 1

Our crude oil forecast for 2023 into 2025 anticipated a significant shift in market dynamics, influenced by cyclical patterns and geopolitical factors. After predicting a period of price volatility throughout 2023, the forecast indicated a decline in early 2024. This anticipated downturn set the stage for a potential turning point, highlighting a crucial period for strategic positioning as we move toward the next phase of the market cycle.

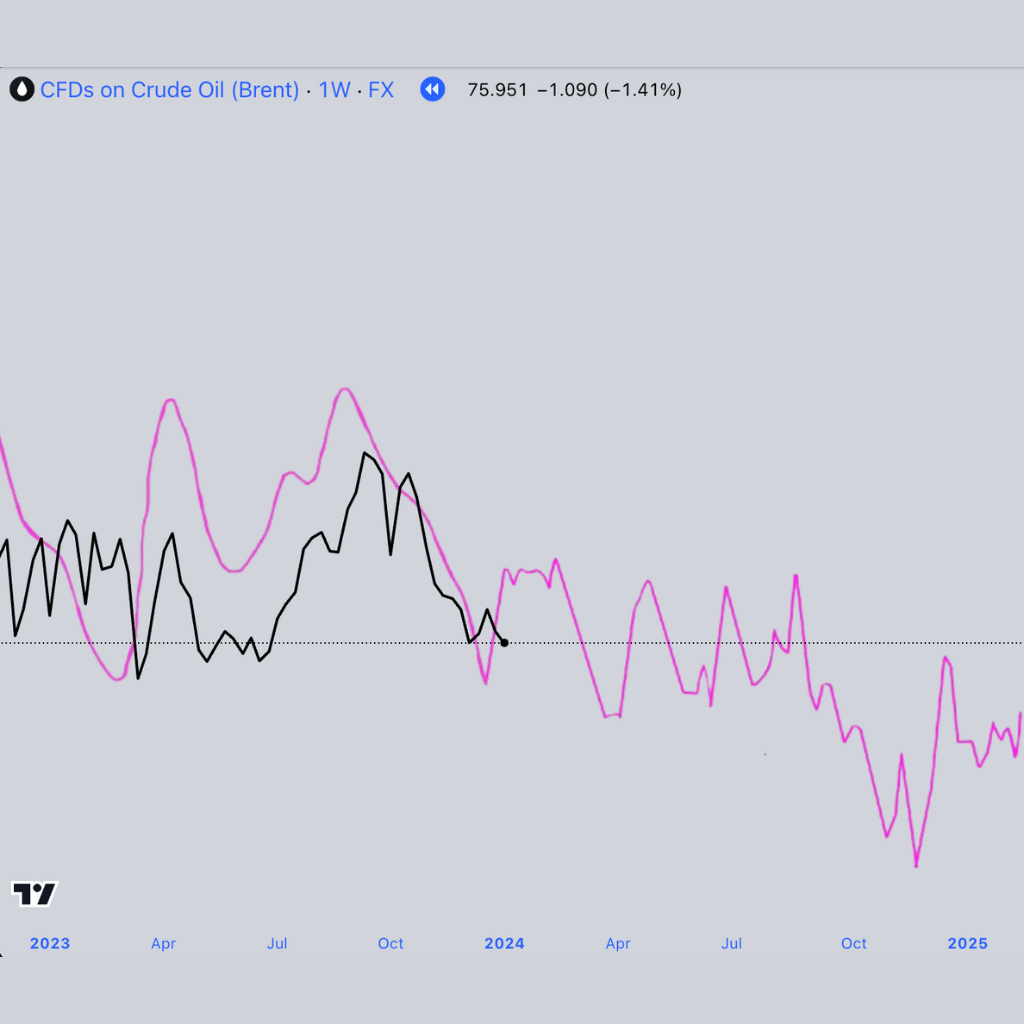

Phase 2

Through 2023 and into 2024, our crude oil forecast anticipated a period of heightened price volatility, driven by supply disruptions and global economic uncertainties. Our cyclical forecasting system successfully identified these key market turning points, oil prices fluctuated within a defined range throughout 2023, reflecting geopolitical tensions and shifting demand. Entering early 2024, we forecasted a drop in oil demand again validating the accuracy of our model and creating the backdrop for the major buying opportunities we have projected.

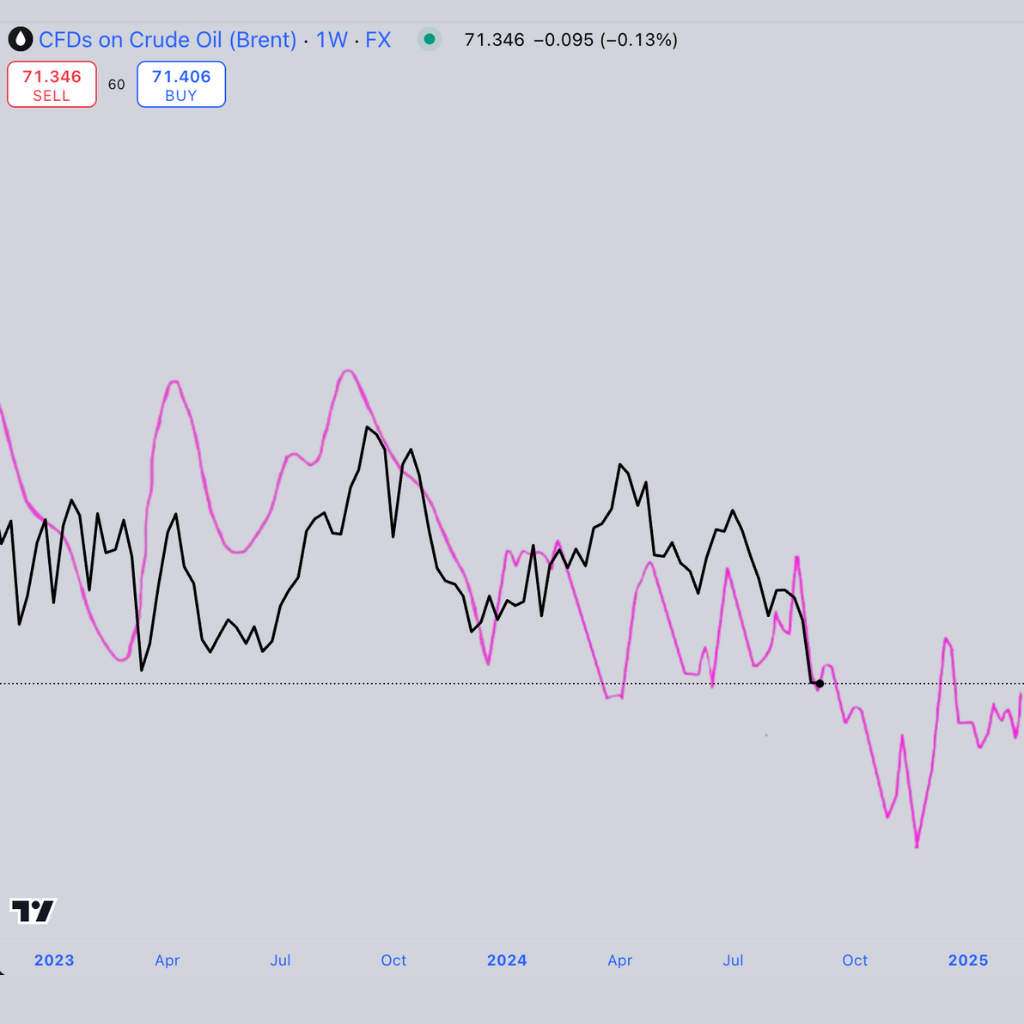

Phase 3

We believe the real opportunity in the oil market is set to unfold shortly, where the foundation for extraordinary entry points will present itself. Our forecasting system has pinpointed this crucial window, where we believe supply constraints and rising global demand will ignite a powerful price surge. The market, which has been simmering with volatility, is poised for explosive growth as geopolitical factors and energy demands converge. For those prepared to act, this is significant moment to capitalise on the next major wave in oil. See (Stock Picks) for more detail.